Introduction

Amid the wave of digital transformation, the financial holding industry is facing mounting challenges, including intensifying market competition, increasingly stringent regulatory requirements, and rapidly evolving consumer behaviors. Leveraging data-driven decision-making to enhance risk management efficiency and drive business growth has become crucial for financial institutions to maintain their competitive edge.

This article will take you on an in-depth exploration of how financial holding companies can harness data to master eight key analytical applications, improving decision-making efficiency, mitigating risks, and unlocking greater business value.

What is Power BI?

Power BI is Microsoft’s data analytics and visualization tool designed to provide enterprises with real-time, intuitive insights. It integrates data from various systems, such as CRM, ERP, and financial reports, enabling businesses to gain a comprehensive data perspective.

With interactive charts and dashboards, users can effortlessly monitor key metrics, quickly identify trends, and detect anomalies. (Further Reading: What is Power BI? 5 Key Features, Use Cases, and Learning Resources – Everything You Need to Know!)

Compared to traditional spreadsheet tools like Excel and Google Sheets, Power BI offers several advantages:

- Comprehensive Data Integration – Seamlessly connects to internal banking systems (CRM, ERP, financial management), market data, and social media analytics, breaking down data silos and providing a holistic data perspective.

- Real-Time Visual Analytics – Dynamic dashboards and interactive charts offer real-time insights into key financial and risk indicators, helping executives quickly grasp market trends and internal performance.

- AI-Powered Smart Analytics – Built-in AI and machine learning capabilities support applications such as credit risk assessment, customer churn prediction, and fraud detection, enhancing data-driven decision-making.

- Low-Code, Easy to Use – An intuitive interface and powerful self-service analytics allow business users to create reports and models effortlessly, reducing reliance on IT departments and improving decision efficiency.

As the financial landscape becomes increasingly data-driven, implementing Power BI not only enhances decision accuracy but also strengthens risk management and optimizes operational processes, making it a critical driver of digital transformation for financial holding companies.

8 Key Power BI Applications in the Financial Holding Industry

In the era of data-driven decision-making, financial holding companies handle vast amounts of financial reports, customer transaction data, risk assessments, and market trends daily. Traditional data analysis methods often rely heavily on manual processing, with data scattered across multiple systems, making real-time integration challenging. This fragmentation can lead to decision delays or missed critical opportunities.

Next, we will explore eight key applications of Power BI in the financial holding industry, covering: investment decision-making, customer management, risk control, financial performance, digital infrastructure, human resources, regulatory compliance, and ESG. These applications demonstrate how Power BI enhances financial operations, improves efficiency, strengthens risk management, and unlocks new growth opportunities.

(1) Investment and Market Monitoring

- Track changes in foreign institutional investors’ holdings and analyze trading trends.

- Analyze market sales data of specific industries (e.g., medical devices) to assess investment risks and opportunities.

- Monitor real-time changes in shareholder structures to optimize investment decisions.

(2) Customer Insights and Marketing Optimization

- Build a 360° customer profile by integrating data from deposits, loans, and credit cards to accurately identify customer needs.

- Predict customer churn risk and adjust marketing strategies to improve customer retention and cross-selling success rates.

- Analyze credit card market share to optimize product strategies and enhance competitiveness.

(3) Financial Management and Operational Performance

- Compare financial performance across different regions or business units to optimize resource allocation.

- Analyze revenue and expenditure trends through profit analysis to improve profitability.

- Monitor corporate travel and operational costs to prevent budget overruns and enhance financial transparency.

(4) Risk Management and Fraud Prevention

- Develop real-time risk monitoring dashboards to detect abnormal transactions and potential fraud.

- Analyze credit risk, predict late payments and defaults, and improve the accuracy of credit decisions.

- Utilize AI-driven forecasting to strengthen regulatory compliance and reduce exposure to risk.

(5) Digital Financial Infrastructure Monitoring

- Monitor ATM and self-service machine network stability to ensure uninterrupted transactions and enhance customer experience.

- Track usage data of mobile banking and digital payment platforms to ensure system stability and high availability.

- Analyze IT equipment depreciation and maintenance costs to optimize IT infrastructure investments.

(6) Human Resources and Organizational Development

- Use Power BI to monitor salary trends across departments and job levels to maintain competitive compensation structures.

- Track recruitment data, analyze the effectiveness of different hiring channels, and optimize talent acquisition strategies.

- Monitor employee turnover rates and performance to improve retention and ensure organizational stability.

(7) Regulatory Compliance and Automated Reporting

- Integrate internal financial, transaction, and risk data to automate regulatory reporting, reducing manual workload.

- Use Power BI to monitor key compliance indicators and ensure adherence to financial regulations and internal risk control standards.

- Track internal and external audit requirements in real time to enhance transparency and minimize compliance risks.

(8) Sustainable Investment and Market Monitoring

- Track ESG rating changes and analyze the impact of environmental, social, and governance (ESG) performance on investment returns.

- Monitor market trends of green financial products (e.g., sustainability bonds, ESG ETFs) to optimize investment portfolio allocations.

- Utilize real-time data to analyze corporate carbon footprints and supply chain risks, ensuring sustainable compliance and mitigating investment risks.

Conclusion

As a powerful data analytics and visualization tool, Power BI enables financial holding companies to integrate vast amounts of internal and external data. Through real-time dashboards, AI-driven predictive analytics, and automated reporting, it provides decision-makers with clear and actionable insights. From investment monitoring, customer management, risk control, and financial optimization to IT monitoring and regulatory compliance, Power BI is no longer just a supporting tool in the financial industry—it has become a key engine for business growth and innovation. (Further Reading: How Power BI and AI Work Together to Maximize Data Value!)

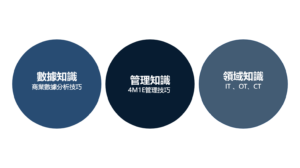

At KSCC, we specialize in talent development and digital transformation, offering corporate training, expert consulting, online courses, and comprehensive Power BI implementation support. Our goal is to ensure that enterprises successfully adopt data analytics solutions and unlock their full potential. Beyond helping businesses build robust data frameworks, we provide hands-on training and advisory services to empower teams with the ability to independently drive data-driven decisions.

Now is the perfect time to take action! Contact Pioneer Think Tank today, and let us guide your team in mastering Power BI, enhancing data-driven decision-making, accelerating digital transformation, and staying ahead in the competitive financial market!